2019 Blue Cross Blue Shield Medicare Advantage Plans

Medicare Advantage enrollment has grown rapidly over the past decade, and Medicare Advantage plans have taken on a larger role in the Medicare program. This data collection provides current information and trends about Medicare Advantage enrollment, premiums, and out-of-pocket limits. It also includes analyses of Medicare Advantage plans' extra benefits and prior authorization requirements.

1. Enrollment in Medicare Advantage has nearly doubled over the past decade

Figure 1: Total Medicare Advantage Enrollment, 1999-2019 (in millions)

In 2019, one-third (34%) of all Medicare beneficiaries – 22 million people – are enrolled in Medicare Advantage plans, similar to the rate in 2017 and 2018. Between 2018 and 2019, total Medicare Advantage enrollment grew by about 1.6 million beneficiaries, or 8 percent – nearly the same growth rate as the prior year. The Congressional Budget Office (CBO) projects that the share of beneficiaries enrolled in Medicare Advantage plans will rise to about 47 percent by 2029.

2. The share of Medicare beneficiaries in Medicare Advantage plans across the United States ranges from 1% to over 40%

Figure 2: Medicare Advantage Penetration, by State, 2019

The share of Medicare beneficiaries in Medicare Advantage plans (including Medicare cost plans), varies across the country. In 28 states and Puerto Rico, at least 31 percent of Medicare beneficiaries are enrolled in Medicare Advantage plans, with more than 40 percent of enrollees in six states (HI, FL, MN, OR, WI, PA) and Puerto Rico. The majority of the Medicare private health plan enrollment in Minnesota has historically been in cost plans, rather than Medicare Advantage plans, but as of 2019, most cost plans in Minnesota are no longer offered and have been replaced with risk-based HMOs and PPOs. Medicare Advantage enrollment is relatively low (20 percent or lower) in 14 states and the District of Columbia, including two mostly rural states where it is virtually non-existent (AK and WY).

3. The share of Medicare beneficiaries in Medicare Advantage plans varies across counties from less than 1% to more than 60%

Figure 3: Medicare Advantage Penetration, by County, 2019

Within states, Medicare Advantage penetration varies widely across counties. For example, in Florida, 66 percent of all beneficiaries living in Miami-Dade County are enrolled in Medicare Advantage plans whereas only 10 percent of beneficiaries living in Monroe County (Key West) do so. In 172 counties, accounting for 10 percent of the population, more than half of all Medicare beneficiaries are enrolled in Medicare Advantage plans or cost plans. Many of these counties are centered around large, urban areas, such as Monroe County, NY (66%), which includes Rochester, and Allegheny County, PA (61%), which includes Pittsburgh. In contrast, in 619 counties, accounting for 4 percent of Medicare beneficiaries, no more than 10 percent of beneficiaries are enrolled in Medicare private plans; many of these low penetration counties are in rural parts of the country but some urban areas, such as Baltimore City (17%), also have relatively low Medicare Advantage enrollment.

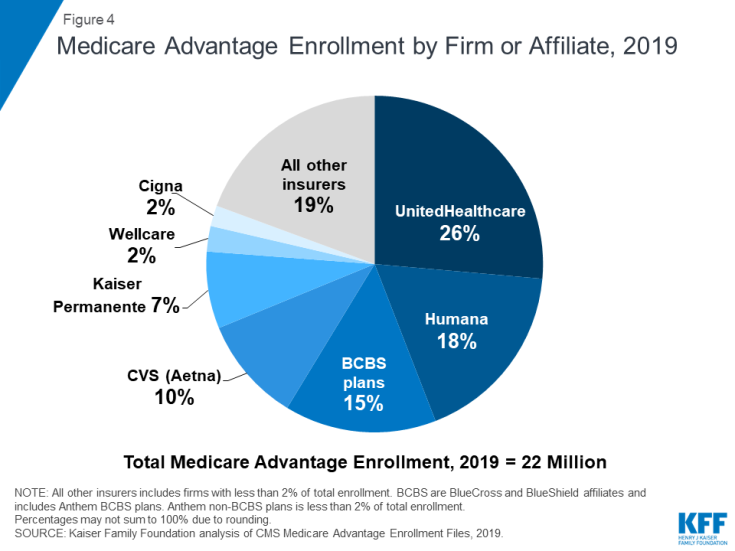

4. Most Medicare Advantage enrollees are in plans operated by UnitedHealthcare, Humana, or BlueCross BlueShield (BCBS) affiliates in 2019

Figure 4: Medicare Advantage Enrollment by Firm or Affiliate, 2019

Medicare Advantage enrollment is highly concentrated among a small number of firms. UnitedHealthcare and Humana together account for 44 percent of all Medicare Advantage enrollees nationwide, and the BCBS affiliates (including Anthem BCBS plans) account for another 15 percent of enrollment in 2019. Another four firms (CVS/Aetna, Kaiser Permanente, Wellcare, and Cigna) account for another 22 percent of enrollment in 2019. For the third year in a row, enrollment in UnitedHealthcare's plans grew more than any other firm, increasing by about 520,000 beneficiaries between March 2018 and March 2019. CVS purchased Aetna in 2018 and the combined company had the second largest growth in Medicare Advantage enrollment in 2019, increasing by also about 520,000 beneficiaries between March 2018 and March 2019.

5. Half of Medicare Advantage enrollees pay no premium (other than the Part B premium) in 2019

Figure 5: Distribution of Medicare Advantage Enrollees, by Prescription Drug Plan Premium, 2019

In 2019, 90% of Medicare Advantage plans offer prescription drug coverage (MA-PDs), and most Medicare Advantage enrollees (88%) are in plans that include this prescription drug coverage. More than half of these beneficiaries (56%) pay no premium for their plan, other than the Medicare Part B premium. However, 21 percent of beneficiaries in MA-PDs (3.0 million enrollees) pay at least $50 per month, including 7 percent who pay $100 or more per month, in addition to the monthly Part B premium ($135.50 in 2019). Among MA-PD enrollees who pay a premium for their plan, the average premium is $65 per month. All together, including those who do not pay a premium, the average MA-PD enrollee pays $29 per month in 2019.

6. Premiums paid by Medicare Advantage enrollees have slowly declined since 2015

Figure 6: Average Monthly Medicare Advantage Prescription Drug Plan Premiums, Weighted by Plan Enrollment, 2010-2019

Nationwide, average Medicare Advantage Prescription Drug (MA-PD) premiums declined by $5 per month between 2018 and 2019, much of which was due to the relatively sharp decline in premiums for local PPOs this past year, and since 2015. Average premiums for HMOs also declined $3 per month, while premiums for regional PPOs were relatively similar between 2018 and 2019. Average MA-PD premiums vary by plan type, ranging from $23 per month for HMO enrollees to $39 per month for local PPO enrollees and $44 per month for regional PPO enrollees. Nearly two-thirds (62%) of Medicare Advantage enrollees are in HMOs, 31% are in local PPOs, and 6% are in regional PPOs in 2019.

7. For Medicare Advantage enrollees, the average out-of-pocket limit is $5,059 for in-network services and $8,649 for both in-network and out-of-network services (PPOs)

Figure 7: Average Medicare Advantage Plan Out-of-Pocket Limits, Weighted by Plan Enrollment, 2019

In 2019, Medicare Advantage enrollees' average out-of-pocket limit for in-network services is $5,059 (HMOs and PPOs) and $8,818 for out-of-network services (PPOs). For HMO enrollees, the average out-of-pocket (in network) limit is $4,706; these plans do not cover services received from out-of-network providers. For local and regional PPO enrollees, the average out-of-pocket limit for both in-network and out-of-network services are $8,796, and $8,901, respectively.

Since 2011, the Administration has required Medicare Advantage plans to provide an out-of-pocket limit for services covered under Parts A and B not to exceed $6,700 (in-network) or $10,000 (in-network and out-of-network combined). Limits have been required for regional PPOs since 2006.

HMOs generally only cover the services provided by in-network providers, whereas PPOs also cover services delivered by out-of-network providers but charge enrollees higher cost-sharing for this care. The size of Medicare Advantage provider networks for physicians and hospitals vary greatly both across counties and across plans in the same county.

8. Most Medicare Advantage enrollees have access to some benefits not covered by traditional Medicare in 2019

Figure 8: Share of Medicare Advantage Enrollees in Plans with Extra Benefits by Benefit Type, 2019

Medicare Advantage plans may provide extra benefits that are not offered in traditional Medicare, and can use rebate dollars to help cover the cost of extra benefits. Plans can also charge additional premiums for such benefits. Most enrollees are in plans that provide access to some dental care (67%), a fitness benefit (72%), and/or eye exams or glasses (78%). Since 2010, the share of enrollees in plans that provide some dental care or fitness benefits has increased (from 48% and 52% of enrollees, respectively) while the share with a vision benefit has been relatively steady (77% in 2010).

9. Nearly four out of five Medicare Advantage enrollees are in plans that require prior authorization for some services

Figure 9: Share of Medicare Advantage Enrollees Required to Receive Prior Authorization, by Service, 2019

Medicare Advantage plans can require enrollees to receive prior authorization before a service will be covered, and nearly four out of five Medicare Advantage enrollees (79%) are in plans that require prior authorization for some services in 2019. Prior authorization is most often required for relatively expensive services, such as inpatient hospital stays, skilled nursing facility stays, and Part B drugs, but infrequently required for preventive services. Beginning in 2019, Medicare Advantage plans can also require enrollees to use "step therapy" for Part B drugs, meaning that they are required to try some specific drugs (and fail to improve on those drugs) before they receive approval to try other drugs. In contrast to Medicare Advantage plans, traditional Medicare does not generally require prior authorization for services, and does not require step therapy for Part B drugs.

10. The majority (72%) of Medicare Advantage enrollees are in plans that receive high quality ratings (4 or more stars) and related bonus payments

Figure 10: Distribution of Medicare Advantage Enrollees by Plan Star Rating, 2015-2019

In 2019, more than two-thirds (72%) of Medicare Advantage enrollees are in plans with quality ratings of 4 or more stars, a decrease from 74 percent in 2018. An additional 2 percent of enrollees are in plans that were not rated because they were part of contracts that had too few enrollees or were too new to receive ratings. Plans with 4 or more stars and plans without ratings are eligible to receive bonus payments for each enrollee the following plan year (2020). The share of enrollees in plans with 2.5 stars (below average ratings) nearly doubled from 3 percent in 2018 to 6 percent (nearly 1 million people) in 2019.

For many years, the Centers for Medicare and Medicaid Services (CMS) has posted quality ratings of Medicare Advantage plans to provide beneficiaries with additional information about plans offered in their area. All plans are rated on a 1 to 5-star scale, with 1 star representing poor performance, 3 stars representing average performance, and 5 stars representing excellent performance. CMS assigns quality ratings at the contract level, rather than for each individual plan, meaning that each plan covered under the same contract receives the same quality rating (and most contracts cover multiple plans).

11. One in five Medicare Advantage enrollees are in employer or union-sponsored group plans in 2019

Figure 11: Distribution of Medicare Advantage Enrollees, by Plan Type, 2019

One in five Medicare Advantage enrollees (4.4 million) are in group plans offered by employers and unions for their retirees in 2019. Under these arrangements, employers or unions contract with an insurer and Medicare pays the insurer a fixed amount per enrollee to provide benefits covered by Medicare. The employer or union (and sometimes the retiree) may also pay a premium for additional benefits or lower cost-sharing. Group enrollees comprise a disproportionately large share of Medicare Advantage enrollees in ten states: Alaska (100%), West Virginia (50%), Michigan (49%), New Jersey (42%), Illinois (39%), Kentucky (38%), Wyoming (37%), Maryland (36%), Delaware (35%), and New Hampshire (33%).

12. Nearly 3 million Medicare beneficiaries are enrolled in Special Needs Medicare Advantage Plans in 2019

Figure 12: Number of Beneficiaries in Special Needs Plans, 2006-2019 (in millions)

Special Needs Plans (SNPs) restrict enrollment to specific types of beneficiaries with significant or relatively specialized care needs. The majority of SNP enrollees (85%) are in plans for beneficiaries dually eligible for Medicare and Medicaid (D-SNPs), with the remainder in plans for beneficiaries requiring a nursing home or institutional level of care (I-SNPs), or with severe chronic or disabling conditions (C-SNPs.)

Enrollment in SNPs increased modestly from 2.6 million beneficiaries in 2018 to 2.9 million beneficiaries in 2019, accounting for about 13 percent of total Medicare Advantage enrollment in 2019, with some variation across states. In seven states, the District of Columbia, and Puerto Rico, enrollment in SNPs comprises at least one-fifth of Medicare Advantage enrollment (51% in DC, 49% in PR, 25% in SC, 22% in NY, 21% in AR, 20% in AZ, 20% in FL, 20% in GA, and 20% in TN). Most C-SNPs enrollees (93%) are in plans for people with diabetes or cardiovascular disorders in 2019. Enrollment in I-SNPs has been increasing, but is still less than 100,000 beneficiaries.

Gretchen Jacobson, Meredith Freed, and Tricia Neuman are with KFF.

Anthony Damico is an independent consultant.

This analysis uses data from the Centers for Medicare and Medicaid Services (CMS) Medicare Advantage Enrollment, Benefit and Landscape files for the respective year, with enrollment data from March of each year. Cost plans are grouped with Medicare Advantage plans, and this chart collection uses the term Medicare Advantage to refer to both types of plans, even though cost plans are paid differently and subject to different rules.

batchelorfeembirl.blogspot.com

Source: https://www.kff.org/medicare/issue-brief/a-dozen-facts-about-medicare-advantage-in-2019/

0 Response to "2019 Blue Cross Blue Shield Medicare Advantage Plans"

Post a Comment